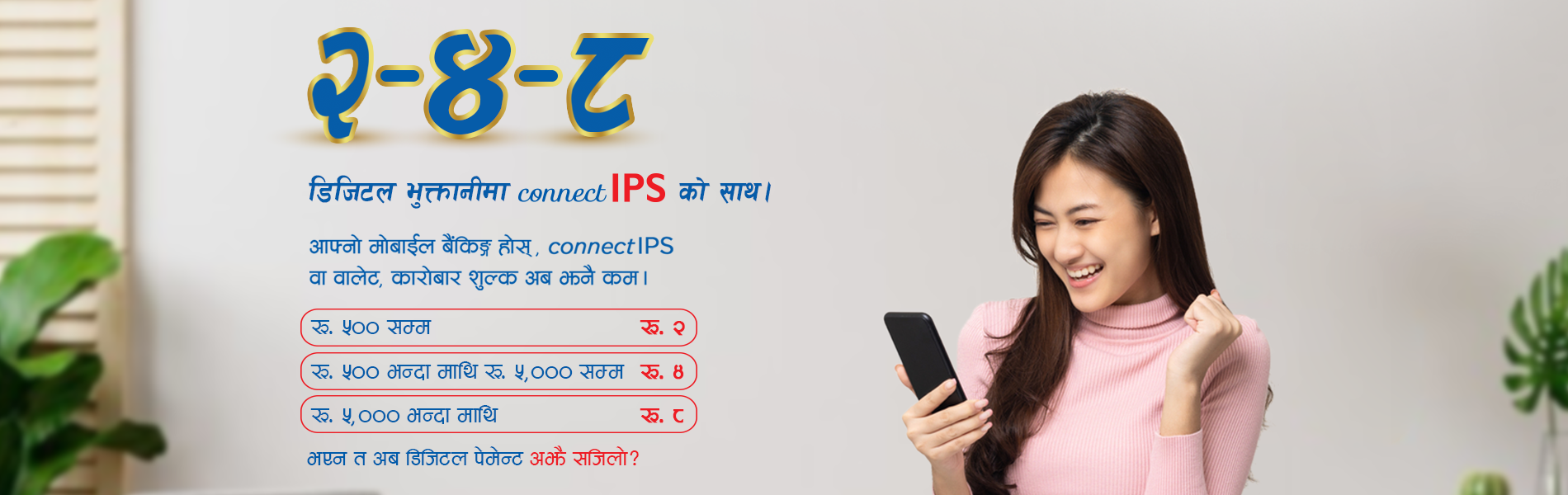

The applicable transactions fee and charges in connectIPS system has been downward revised with effect from 7th Mangsir 2078 (23rd November 2021). With the new structure, the transaction fee is applicable to the customers of the Banks & Financial Institutions (BFIs) and Payment Service Providers (PSPs) has been reduced to NRs 2-8, based on transaction amount.

Transaction Amount Slab based Fee Structure for general customers of BFIs and PSPs is revised as follows:

|

S.N. |

Transaction Amount (NRs.) |

Transaction Fee ( NRs.) |

|

1 |

Upto 500 |

2 |

|

2 |

Above 500 - 5,000 |

4 |

|

3 |

Above 5,000 |

8 |

The revised charges shall be applicable while initiating fund transfer from connectIPS web, mobile app, member bank/financial institutions’ alternate channels of mobile & internet banking, Cash In/Out in various member wallets (PSPs) and various service payments where end customer has to pay. Government of Nepal’s Inland Revenue tax payment is already cross-subsidized at NRs 2-5. Refer < connectIPS Fees and Charges> for details.

How to do fund transfer from mobile banking app using connectIPS?

(You do not require separate connectIPS user details to do fund transfer from mobile banking app)

How to do fund transfer from web or mobile app of connectIPS?

What is the transaction limit in connectIPS?

|

|

Web Channel |

Mobile Channel |

|

Maximum amount per transaction |

NRs. 20,00,000 |

NRs. 2,00,000 |

|

Transaction Per Day Count |

100 |

100 |

|

Maximum transaction amount per day |

NRs. 20,00,000 |

NRs. 2,00,000 |

*Limit is per user per bank

*Respective banks and financial institutions may have different limits as per their internal policy

*Limit may change with /without notice as per Nepal Rastra Bank directive

connectIPS fund transfer is available in mobile banking of the following BFIs:

Commercial Banks :

Agriculture Development Bank Ltd.

Bank of Kathmandu Ltd.

Century Bank Ltd.

Citizens Bank Ltd.

Civil Bank Ltd.

Everest Bank Ltd.

Global IME Bank Ltd.

Himalayan Bank Ltd.

Kumari Bank Ltd.

Laxmi Bank Ltd.

Machhapuchhre Bank Ltd.

Mega Bank Ltd.

Nabil Bank Ltd.

Nepal Bangladesh Bank Ltd.

Nepal Bank Ltd.

Nepal Credit & Commerce Bank Ltd.

Nepal Investment Bank Ltd.

NIC Asia Bank Ltd.

NMB bank Ltd.

Prabhu Bank Ltd.

Prime Bank Ltd.

Rastriya Banijya Bank Ltd.

Sanima Bank Ltd.

Siddhartha Bank Ltd.

Sunrise Bank Ltd.

Development Banks :

Excel Development Bank Ltd.

Garima Bikas Bank Ltd.

Green Development Bank Ltd.

Jyoti Bikash Bank Ltd.

Kamana Sewa Bikas Bank Ltd.

Lumbini Bikas Bank Ltd.

Mahalaxmi Bikas Bank Ltd.

Miteri Development Bank Ltd.

Muktinath Bikas Bank Ltd.

Shangrila Development Bank Ltd.

Shine Resunga Development Bank Ltd.

Sindhu Bikas Bank Ltd.

Finance Companies :

Best Finance Co. Ltd.

Central Finance Ltd.

Goodwill Finance Ltd.

Guheshwori Merchant Banking & Finance Ltd.

ICFC Finance Ltd.

Manjushree Finance Ltd.

Progressive Finance Ltd.

Samriddhi Finance Co. Ltd.

Fund load/withdraw through connectIPS is available in the following PSPs:

Cellpay

CG Pay

Digipay (withdraw only)

Dpaisa

edheba

Enet

icash

IME Pay

Khalti

Lenden

Mobalet

Moru

nCash

Paytime

Paywell

Prabhu Pay

QPay

Sajilo Pay

Smart Card